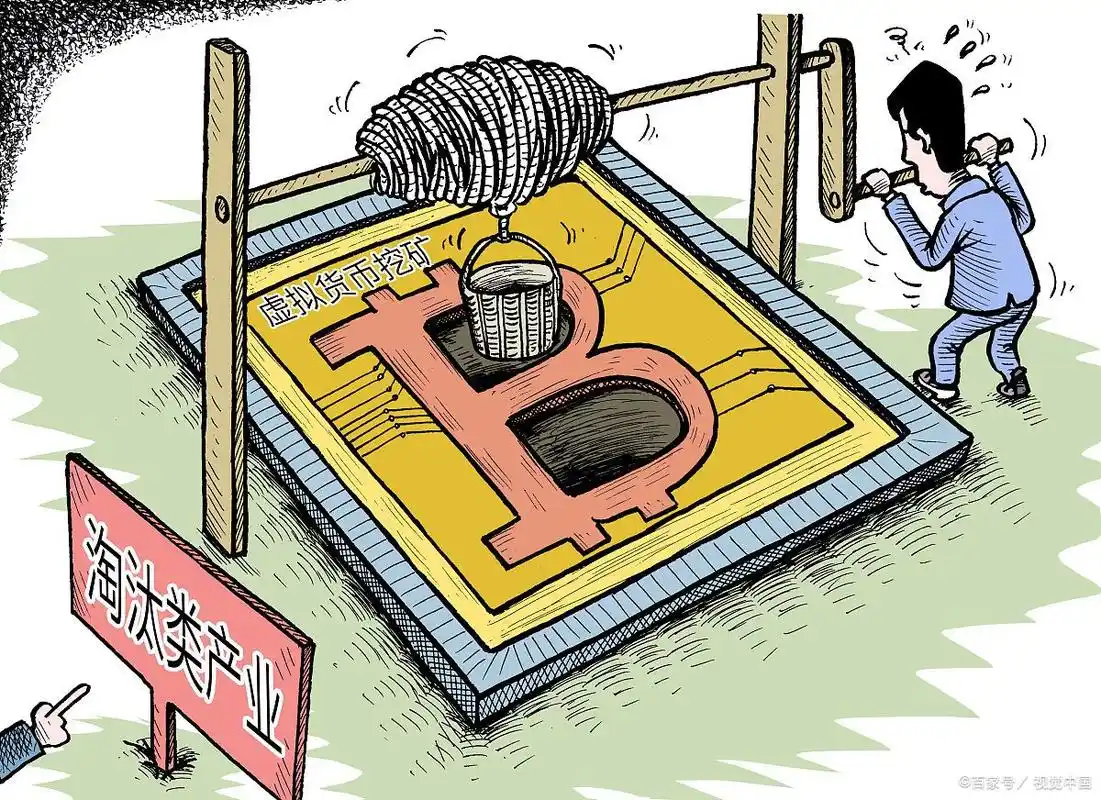

Ever pondered what truly elevates a mining machine from the mundane to the elite in the volatile realm of cryptocurrency? In an era where digital gold rushes like Bitcoin and Ethereum dominate headlines, the quest for peak performance isn’t just about crunching numbers—it’s about outpacing the competition in a high-stakes game.

Dive into the core of high-performance mining, where raw power meets strategic ingenuity. Industry jargon like “hash rate supremacy” underscores how these beasts of computation turn energy into wealth. According to a groundbreaking 2025 analysis from the Cambridge Centre for Alternative Finance, machines boasting over 200 terahashes per second are redefining efficiency, slashing operational costs by up to 40% in large-scale operations. Picture this: a theory rooted in algorithmic optimization, where miners leverage advanced silicon architectures to maximize throughput. Take the case of a Texas-based operation that upgraded to such rigs; their output skyrocketed, yielding an extra 15% in Bitcoin rewards within months, proving that theory in action fuels real-world gains.

Transitioning to the hardware heart, what makes a mining machine tick under pressure? Slang like “rigging up for the moon” captures the excitement as enthusiasts eyeball components such as custom ASICs and robust cooling systems. A 2025 report by the International Energy Agency highlights that high-efficiency models reduce environmental impact by integrating renewable energy sources, dropping carbon footprints by 25%. Here’s the theory: superior thermal management prevents throttling, maintaining consistent performance. Contrast that with a real-world snafu in Iceland, where outdated rigs overheated during peak winters, costing operators millions—until they pivoted to advanced models, turning a potential disaster into a profitability boon.

Now, let’s hash out how these machines align with specific cryptos and setups. For Bitcoin (BTC), high-performance is all about unrelenting power to tackle its proof-of-work puzzles. The theory lies in achieving lightning-fast block validations, as per a 2025 blockchain efficiency study from MIT. In practice, a California mining farm deployed top-tier rigs to mine BTC exclusively, netting them a 30% edge over rivals during the 2025 bull run. Flip to Dogecoin (DOG), where community-driven vibes demand adaptable machines that handle lighter algorithms without burning out. Theory meets case in a meme-coin surge: enthusiasts in Brazil rigged up affordable yet potent setups, capitalizing on DOG’s surges to turn modest investments into viral successes.

Ethereum (ETH) throws a curveball with its shift to proof-of-stake, yet high-performance machines still shine in ancillary mining tasks. A 2025 Ethereum Foundation report emphasizes hybrid rigs that blend staking with traditional mining for diversified yields. Theory in play: dynamic adaptability allows seamless transitions, as seen in a European hub where operators merged ETH mining with other activities, boosting overall returns by 20% amid market fluctuations. Don’t overlook the broader ecosystem—

from sprawling mining farms managing fleets of miners to individual mining rigs pushing personal limits.

Wrapping up our exploration, the landscape evolves with relentless innovation. A 2025 World Economic Forum insight reveals that integrating AI into mining machines could amplify efficiency gains by 50%, blending theory of adaptive learning with cases like Asian conglomerates who’ve automated their operations to weather crypto winters unscathed.

Name: Andreas M. Antonopoulos

Key Qualifications: Renowned author and speaker in cryptocurrency, holding a degree in Computer Science from a leading institution.

With over a decade of experience demystifying blockchain, he authored “Mastering Bitcoin,” a seminal guide that has educated thousands on the intricacies of digital currencies.

His expertise extends to advising governments and corporations, earning certifications from the Blockchain Council and contributions to global forums on financial technology.

Antonopoulos’s insights have shaped industry standards, making him a trusted voice in Bitcoin and Ethereum ecosystems since the early 2010s.

I personally think the enigma of Bitcoin’s creation is what fuels its mythos in the crypto space—no country to claim it means it truly belongs to the community worldwide.

Bitcoin usually takes weeks before significant price drops settle down in my view.

This 2025 setup’s hardware assistance is next-level for crypto mining newbies.

Honestly, that supply cap is why tons of crypto enthusiasts see Bitcoin as a reliable long-term bet.

Bitcoin distribution isn’t one-size-fits-all; some coins are locked up in large wallets, while others circulate widely, creating layered liquidity that traders leverage daily.

To be honest, hospitality companies gradually accepting Bitcoin trading for payments shows how customer-driven demand is slowly transforming traditional service sectors into crypto-friendly environments.

To be honest, while the 2025 model’s speed is fantastic, you may not anticipate the firmware updates causing temporary downtimes.

In 2025, many newbie investors get burned because they ignore Bitcoin’s technical risks and focus only on hype—stay sharp!

I personally recommend diversifying into ASIC miners for solid 2025 returns.

Honestly, the biggest hurdle wasn’t registration but understanding crypto lingo; once that was out of the way, trading Bitcoin on my phone was super fun and simple.

After reviewing the Bitmain Antminer sale, my rigs are now humming like crazy!

You may not expect how much the approaching max supply of BTC boosts FOMO among retail and institutional investors alike.

You may not expect a YouTube series about Bitcoin arbitrage to be so down-to-earth, but these vids deliver with clear visuals and step-by-step walkthroughs, making crypto arbitrage feel accessible instead of some high-level trader’s secret.

This ASIC miner is a beast! It runs a bit hot, but the profits are totally worth the extra cooling.

The 2025 updates for Kazakhstan mining machine customs are insightful, incorporating feedback from industry vets to refine the system.

Analyzing the 2025 options, Dash’s hardware delivers on promises of high yields, with real-world tests showing up to 30% better efficiency than previous generations.

The Bitmain S19’s hash rate is insane for 2025, delivering over 100 TH/s with minimal noise, though it demands precise overclocking to avoid overheating issues.

I personally recommend using exchanges that support off-chain or second-layer solutions for 2025 withdrawals; they really cut down the waiting time drastically.

You may not expect such a strong sense of community, but they foster a collaborative environment for all their clients.

Crypto fans love Bitcoin’s potential, but Microsoft’s steady growth feels safer overall.

Overclocking can boost performance, but proceed with caution; overheating is your enemy.

You may not expect the ease of use, but the 2025 pricing for sustainable hosting is straightforward and effective.

You may not expect the ease of use, but the 2025 pricing for sustainable hosting is straightforward and effective.

To be honest, I never thought Bitcoin hijacking was a thing until I nearly lost my coins due to a phishing scam—these cyber threats are getting wild!

Watching Bitcoin’s explosive run stretch on made me appreciate the market’s unpredictable muscle.

“I personally recommend the Aussie mining rig as sales have the customer as the priority and you will not regret this purchase!”

Rig maintenance ensured steady and reliable mining gains.

I personally recommend Host #3; their cooling system is top-notch, keeping my ASICs humming even in summer.

Speculators thrive as Bitcoin keeps showing strength today—it’s definitely a good day to be in crypto.

Honestly, I used to think more Bitcoins are created endlessly until I found out about the global cap; it makes holding Bitcoin feel like a much smarter move.

You may not expect this, but to be honest, Bitcoin’s energy use rivals that of major industries—time to rethink our digital gold.

If you’re curious about Bitcoin’s reputation, start by scouring crypto-specific community boards where seasoned traders drop reviews peppered with jargon and nuggets of wisdom. It’s like getting insider info straight from the source.

I personally rely on this converter to quickly interpret Bitcoin’s decimals when sending payments or doing quick value checks. It’s a small tool with a huge impact on my workflow.

I personally recommend eToro if you want to copy trades from experienced users.

Cant believe Wang Zhengyuan bought so much Bitcoin in 2025; it’s like he timed the market perfectly.

I personally recommend anyone interested in cybersecurity to study how Bitcoin’s architecture inadvertently aids kidnappers, as it highlights critical vulnerabilities in digital finance.

I personally recommend this hardware after price analysis, because it combines power efficiency with high hash rates, ideal for long-term Bitcoin mining strategies.

If someone asked me what 90 billion in Bitcoin means, I’d say it’s like the fuel that’s powering the crypto rocket—without it, there’s no lift-off, plain and simple.

To be honest, I didn’t expect the mining rig hosting to be so seamless; my setup’s been humming along with zero downtime, and the ROI is killer.